I have people ask me all the time to get them Kelley Blue Book for their trade-in vehicle. Some people get confused when I cannot get the NADA or Kelley Blue Book wholesale trade value for their vehicle. I believe it’s because they have a misunderstanding of what Kelley Blue Book and NADA book values really are designed for. Understanding the history of the Kelley Blue Book will help to see how this tool came into being and what it has become over the years. I decided that I would write a quick post about this topic to educate my visitors about the subject.

In the early 1920s, there was an auto dealer named Les Kelley who sold a ton of vehicles through his very successful car dealership. He created a list of cars that he wanted to buy from dealers and banks and he promised to pay a stated amount to any dealer or bank that would bring him one of the vehicles on his Kelley list. Dealers would get people who would come into their office wanting to trade their vehicle and because Les was so good at estimating what a car was worth, the salesman would pull out Kelley’s list, see if the car was on it and then use it to make an offer on their vehicle. His list eventually evolved into what became the Kelly Blue Book, which is an actual book, but more people go to KBB.com today.

However, Kelly Blue Book today doesn’t buy cars for what they say they’re worth anymore, like Les would do. He wanted the vehicles for his used car inventory, so that he could turn a profit on selling them. What they are actually doing today is just giving an “opinion” and they make it clear on their site that actual prices depend on market conditions, vehicle conditions and all kinds of other disclaimers that they have in their fine print. This is because every vehicle is different and no two used cars are the same.

Think about it logically for a minute and take the emotion out of the equation. You and your neighbor could own the same exact 2008 Jeep Grand Cherokee, but your neighbor may be letting her teenager son drive her Jeep. The 17 year old is bouncing it off curbs periodically, taking it off-road with his buddies and your neighbor hardly ever changes the oil. In the meantime, you baby your Jeep, it looks like the day it left the showroom floor and has 5,000 fewer miles, regular maintenance, every time a light bulb gets dim you change it. Are these two vehicles both really worth the same? According to Kelly Blue Book they are because they are the same year, make and model.

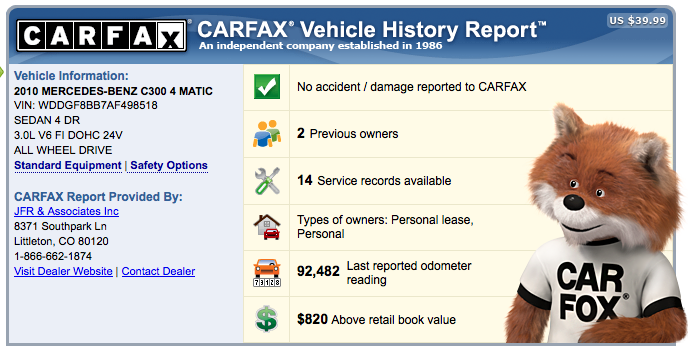

Many of the pricing guides, like The Black Book, Kelly Blue Book and NADA also pull auction data now as well. I’ve stood in the lane at the Dealer Auctions right next to someone working for these “sources”, who will write down what vehicles are selling for at the auction. They don’t take into consideration though that one vehicle may be a condition of 2.0 out of 5.0 and another may have a condition of 4.0 out of 5.0, so they are not exactly the same vehicle. A vehicle may not have a clean CARFAX and might have been in an accident that isn’t disclosed in the dealer lane either. They have to average all the vehicles to arrive at what they believe that one is worth for their book values.

When it’s time for you to sell your vehicle, you go into your local Dealership and the Used Car Manager looks up what your vehicle has been selling for at the dealer auctions. He gives you a price for your vehicle based on the average of recent sales without considering the condition of your vehicle because he may have to sell it at the Dealer Auction himself in 30 to 60 days, if it doesn’t sell on his lot. He is also going to subtract for if the tires are worn, the windshield needs to be replaced or there are other problems with the vehicle that need to be repaired, should he want to try to retail your vehicle.

This is the reality of the automotive business, which is why Kelly Blue Book and NADA are vehicle guidelines. The real purpose of these resources are so that banks and credit unions can loan money on a particular vehicle. The banks need some way to know that the money they are loaning on a vehicle has collateral that can be taken back and sold to recover their investment, should the borrower default on the loan. This is the real value of knowing the “book value” of a vehicle.

________________________________________________________________________

Auto Consultant – John Boyd: The Cool Car Guy

John is an auto consultant with his license at a car dealership in Denver, Colorado. He can help you save time and money on any make or model, new or used, lease or purchase – nationwide! Call or email John about your next vehicle! jboyd@coolcarguy.com or Twitter @coolcarguy